Infant nutrition market in China: what are the growth drivers in this changing market ?

Infant nutrition is a segment that includes first-age (0 to 6 months), follow on (6 to 12 months), and growing up (12 months to 3 years) milks, as well as other baby foods. This market was valued at 77 billion US dollars worldwide in 2022 and its growth is estimated at +7 % by 2027 [1]. What is China’s place in this global dynamic ? Here is an overview of the infant nutrition market in China.

The global infant nutrition market is dependent on China

China dominates the global infant nutrition market

In both value and volume, China is the leading country in the global infant nutrition market with nearly 50 % market share in value. Experiencing double-digit growth between 2004 and 2019, this market has increased in value from $2 billion to $24 billion [2]. In 2019, China accounted for nearly 2/3 of global growth in the sector [2].

It is estimated that in the powdered milk category alone, the infant nutrition market in China is equivalent to a volume of 900,000 tons per year, including sales in supermarkets, on the grey market and purchases on the Internet.

A recent expansion but limited by the Chinese demographic crisis

The rapid development and expansion of infant nutrition in China is relatively recent. It is only in the late 20th century and even in the early 21st century that the demand for infant formula has grown. Over the past decades, the market has been influenced by various factors. Its growth has long been driven by the urbanization of lifestyles, the development of the middle class and the increase in female employment. All of these factors have led to a decrease in breastfeeding [2].

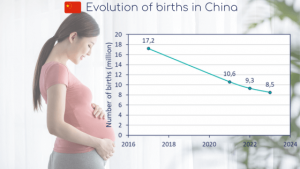

For the past few years, the infant nutrition market in China has been experiencing a clear slowdown in growth, directly related to the birth crisis the country is experiencing. Between 2017 and 2021, the number of births fell from 17.2 to 10.6 million. For 2023, the Chinese National Bureau of Statistics forecasts an annual figure of only 8.5 million. As a direct consequence, Chinese infant formula consumption decreased by 6% in volume between 2017 and 2021 [3].

This birth crisis can be explained by several factors, including:

-

-

- The high cost of child-rearing and education per child: more than 15 times per capita disposable income in 2021 [4]

- The decrease in the number of women of childbearing age

- The lack of women compared to the number of men and the difficulty of meeting them

- The cost of housing

- The evolution of the family model and lifestyles

-

Added to this is the ineffectiveness of Chinese government policies encouraging families to have a second or even third child.

What are the trends in the infant nutrition market in China?

Increasingly powerful local players

After years of mistrust following the melamine crisis in 2008, Chinese consumers are gradually regaining confidence in their local producers of infant formulations. A dynamic that has been encouraged by the public authorities since the publication of the “Action Plan for the Promotion of Domestic Infant Milk Powder” by the government in 2019 [5]. As a result, local production has risen sharply, causing the market share of Chinese players in terms of volume in their own territory to jump from 19 % in 2016 to 38.8% in 2021 [7].

In this context, where the demand for infant formulas is decreasing and local production is increasing, China has reduced its infant formula imports by more than 20 % between 2020 and 2021 [6,7]. Some major international players have even withdrawn in the face of changing market conditions, made more complex by the implementation of new Chinese regulations aimed at reducing the number of formulations marketed.

Two trends against the grain: premiumization and market accessibility

In recent years, two contradictory trends have been driving the infant nutrition market in China. On the one hand, the demand for premium products has increased significantly in recent years. In fact, this segment of infant nutrition has seen an increase in its market share in terms of value from 24% in 2016 to 47% in 2020. This segment’s market share is forecast to reach 58% of total market value by the end of 2023 [8]. However, premium products being significantly more expensive, while this growth appears important in terms of value, it is actually limited in volume because these products remain inaccessible for most Chinese parents.

On the other hand, there is a rise in more accessible offers, driven by Chinese government policies. These decisions mainly target the middle class to encourage them to have children and thus attempt to stem the decline in the birth rate.

A rapidly changing market in suggesting a total redistribution of the cards

The infant nutrition market in China thus seems to be moving at two opposite speeds in a global economic climate that is less dynamic than in previous years. A two-speed market in which the race for added value remains marked by innovation with, for example, goat’s or sheep’s milk formulations, and the search for solutions to offer more affordable formulations in response to middle-class demand. This market will therefore deserve our full attention in the years to come…

Click here for to find out more about the value of dairy ingredients in infant formulas.

Sources:

[1] MordorIntelligence, Infant nutrition market – growths, trends, COVID-19 impact, and forecasts, 2022

[2] Businesswire, China Infant Formula Market Size, Trends & Forecasts 2021-2025, 2022

[3] Globaldata, China Baby Food Market Size by Categories, 2021

[4] YuWa Population Research, Jefferies, OECD, National Bureau of Statistics, 2022

[5] Les Echos, Chine, lait infantile, Nestlé, Danone : Petit empereur deviendra grand, 2021

[6] Eucolait, China Infant Formula, 2021

[7] Statista, Market size of infant formula in China, 2021

[8] Frost and Sullivan report, 2021